Investors

At Versamet, our vision is to build a premier mid-tier precious metals royalty and streaming company that drives long-term per share value for stakeholders.

Our strategy prioritizes returns and versatility over rigid commodity mixes or contract structures, emphasizes rapid growth through large deals, focuses on near-term free cash flow generation and fosters strong, enduring partnerships. Through our vision and strategy, we align with the key drivers of success: scale, quality, access to capital, and consistent, above-cost-of-capital returns.

Highlights

Strong cash flowing platform poised for significant growth

Versamet’s portfolio produced 5,100 GEOs in 20241 and has the potential to grow over 20,000 GEOs by 20262.

1. Gold Equivalent Ounces for 2024 calculated by dividing total revenue of approximately US$12.0 million by the average realized gold price of US$2,376 per ounce.

2. Potential for attributable GEO production to be over 20,000 GEOs in 2026 based on assumption that Greenstone, Kiaka, Toega, Kolpa, Rosh Pinah Zinc, Santa Rita and Blackwater and Mercedes production is at a rate that is within 15% of the latest publicly disclosed forecast by each mine operator as of March 2025.

Well-defined strategy with a team that can execute

Versamet team has completed over US$400M in acquisitions since 2022.

Large-scale optionality and organic growth potential

Significant optionality with large-scale projects with extensive resources advanced by reputable, financially capable mining operators.

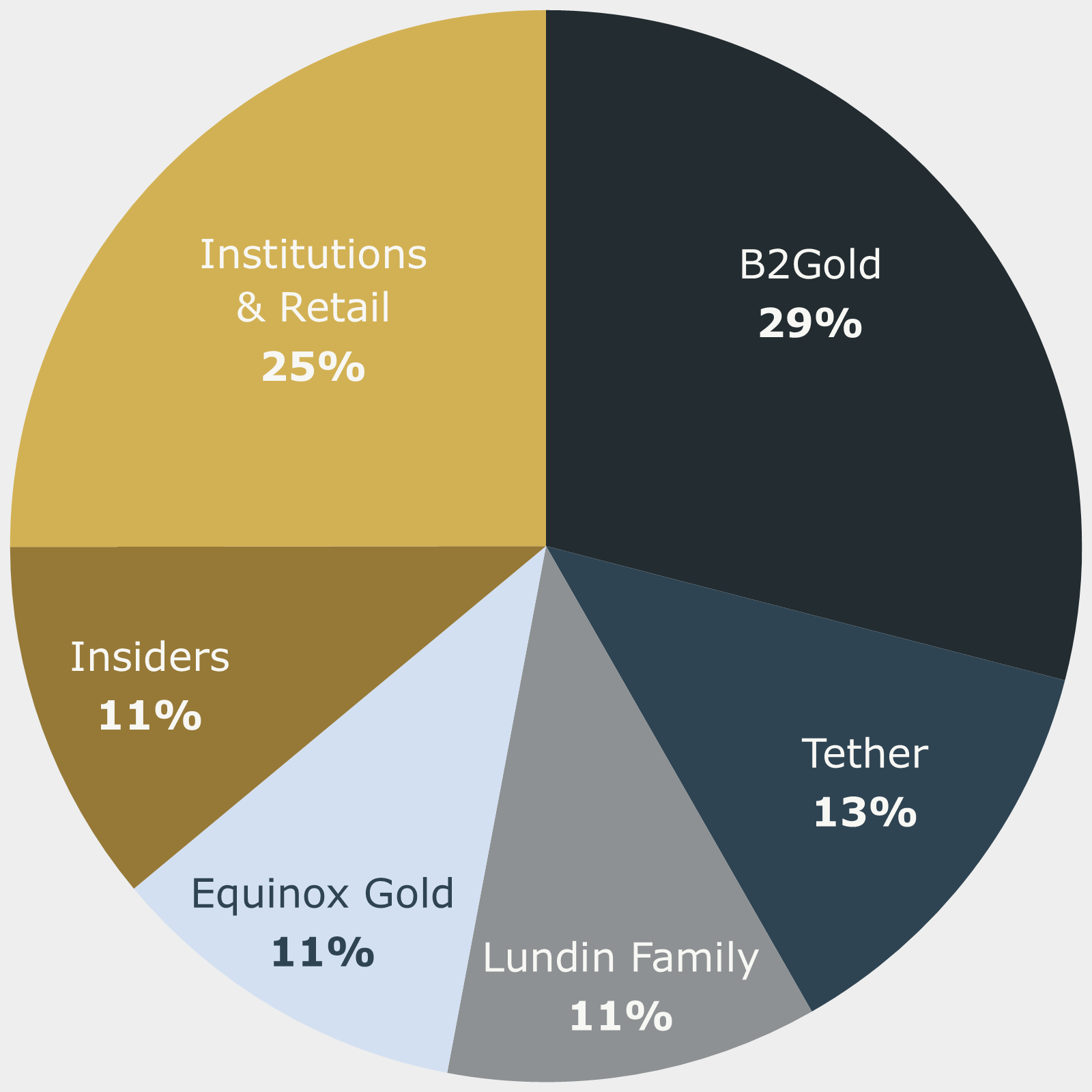

Quality sponsorship aligned for success

Versamet is backed by industry leaders which includes B2Gold, Tether, the Lundin family, and Equinox Gold.

Investor Presentation

Download PresentationMedia Coverage

Featured Video

-

-

-

The Korelin Economics Report

Acquisition of 2 Cash-flowing Assets, Portfolio Review of Producing Royalties and Streams, Triple-Pronged Platform for Future Growth

Podcast//

20:44 -

Analyst Coverage

| Institution | Name |

|---|---|

| Ventum Financial | Maximillian Myers |

| Cormark Securities | Nicolas Dion |

| National Bank | Alex Terentiew |

| Raymond James | Brian MacArthur |

Financials

For a full list of regulatory filings, please refer to Versamet’s SEDAR+ issuer profile at www.sedarplus.ca

2025

Corporate Governance

For more information regarding Versamet’s corporate governance practices please contact us.

Explore the Portfolio

Discover our growing portfolio of cash-flowing and development royalties and see for yourself what makes Versamet stand out.

Explore Royalties